Free Training Friday 6: Diluted Share Count and Enterprise Value

Out of everything I do, I love helping people learn and improve people’s skills and knowledge the most.

Selfishly, I’ve always loved helping people more than helping myself because it makes me feel good.

Download A Free Copy of My Acclaimed Value Investing Education Book How To Value Invest By Clicking Here.

But talking to students and clients, and being with them when they finally “get it”, and when concepts, terminology and techniques begin clicking into place, is absolutely amazing to be a part of.

In this brand new series, we’re bringing those two things together and much more.

In this series, I’m going to release a new training video / session every Friday, on the blog to help you improve your value investing skills and knowledge so you can reach your goals faster.

We are also going to turn these sessions live at some point as well.

Once we get going here, we’re also going to do live training and Q&A sessions in this series.

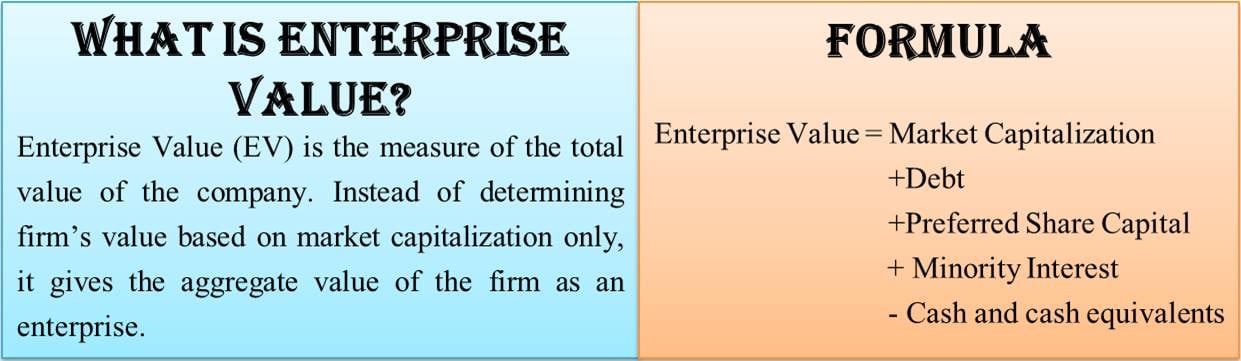

The training session below is from one of my $10,000 Coaching Sessions. This is one of our early videos where we begin to talk about foundational value investing knowledge and concepts; in this video, diluted share count and enterprise value.

This is only Part 2, where we talk about foundational value investing concepts.

In Part 1, we talked about foundational value investing concepts.

If you want to see this full series, go here.

But why do we spend so much time talking about these things?

Tired of wasting time learning how to find, evaluate, and value stocks all by yourself? If you're ready to learn more today check out our Value Investing Masterclass by clicking here.

Because I’m a huge believer that once you have the proper value investing foundation down, or any skills basic foundations, it will make things much easier to learn down the road for you.

Plus once you have these foundational concepts down, you won’t have to go back and keep re-learning these things over and over again.

I did this when I first started and wasted literally years of time.

Don’t do this.

In the video, we talk about the following things:

- Why these kinds of concepts are so important

- How can they save you an immense amount of time down the road

- Why making sure decimal places are in the correct place is ultra important

- Why converting currency is ultra important

- And much more…

I’m a huge believer in being as efficient as possible to help speed up not only the learning process for you, but also, personally, so I spend less time having to backtrack and relearn things.

By drilling in this and the other free future foundational value investing videos, you’ll save yourself an enormous amount of time and frustration.

I’m all about leveraging time and gaining a huge legal advantage over others, this is a huge positive leverage point.

Let’s get to it.

Here are the other resources on this video from the Value Investing Journey Training Vault that are also for free:

- Why the P/E is Useless and How to Calculate EV

- Don’t Be a One Legged Person in an Ass Kicking Contest – My Answer to Why Valuation is Important

If you missed the prior videos in this series, you can view them using the links above.

Until we get the live training / Q&A sessions up and running, let me know if you have any questions or comments or specific scenarios you want to know about when it comes to a thorough preliminary analysis or foundational value investing knowledge, so I can make another video on them or even make you a video personally. Or even do a FREE live training session just with you.

P.S. The video above is from one of our $10,000 Coaching Sessions. If you want to learn more about this program for yourself go here.

P.P.S. These videos, and 170+ more training videos as of this writing, are all in our Value Investing Journey Training Vault, that you can now get for a limited time for only $49 a month, for the first 100 people that sign up. Click the link above to get this program before this offer is gone.