Free Training Friday 11: EV, Diluted Share Count, and Deliberate Practice

Out of everything I do, I love helping people learn and improve their skills and knowledge the most.

Selfishly, I’ve always loved helping people more than helping myself because it makes me feel good.

Get FREE access to 17 of our best training videos from the past by clicking here.

But talking to students and clients, and being with them when they finally “get it”, and when concepts, terminology and techniques begin clicking into place, is absolutely amazing to be a part of.

In this brand new series, we’re bringing those two things together and much more.

In this series, I’m going to release a new training video / session every Friday, on the blog to help you improve your value investing skills and knowledge, so you can reach your goals faster.

We’re also going to turn these sessions live at some point.

The training session below is from one of my one on one coaching clients. For more info on that program, go here.

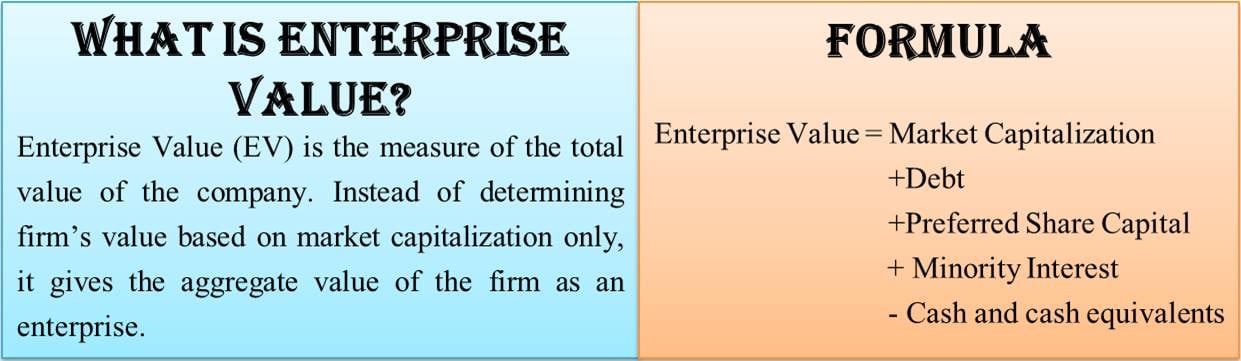

This is one of our early videos where we begin to talk about foundational value investing knowledge and concepts – in this video, diluted share count and enterprise value.

In Part 1 we talked about foundational value investing concepts.

In Part 2 we talked about diluted share count and EV.

Today we continue talking about EV, Diluted Share Count, and Deliberate Practice.

If you want to see our full Free Training Friday series that is now up to 11 video training sessions, go here.

Want to learn how to find, evaluate, value, and buy great stocks fast? Ones that have helped me produce average annual investment returns of 23.5% per year on average in the first 9 years of my career? Click here to learn more about our Value Investing Masterclass.

But why do we spend so much time talking about these things?

Because I’m a huge believer that once you have the proper value investing foundation down – or any skills basic foundations – it will make things much easier to learn down the road for you.

Plus, once you have these foundational concepts down, you won’t have to go back and keep re-learning these things over and over again.

I did this when I first started and wasted literally years of time…

Don’t do this.

I’m a huge believer in being as efficient as possible to help speed up not only the learning process for you, but also, personally, so I spend less time having to backtrack and re-learn things.

By drilling in this and the other lessons from our free training video sessions, you’ll save yourself an enormous amount of time and frustration.

I’m all about leveraging time and gaining a huge legal advantage over others – this is a huge positive leverage point.

Having said that, let’s get to this week’s video…

Here are the other resources in this section from the Value Investing Journey Training Vault for free as well…

- Why the P/E is Useless and How to Calculate EV

- Don’t Be a One Legged Person in an Ass Kicking Contest – My Answer to Why Valuation is Important

Also remember, if you have any questions about anything in this video or its larger series, let me know in the comments below so I can answer it for you.

P.S. If you want to become a better value investor fast, make sure to check out our Value Investing Journey Masterclass. There are ONLY 7 spots left for our special offer that you will only hear about if you set up a call with me by using the prior link. The special offer available to only 7 more people is 5 FREE one on one training sessions with me.

P.P.S. Go here to get on our free mailing list where not only will you get updates first on sales, content, videos, new courses, etc., but you’ll also get 5 free gifts.

By signing up for free, you’ll instantly get five free gifts – including the preliminary analysis checklist and research procedure document I’ll use every time I evaluate a company in this series.