Value Investing In Your Car Episode 26: If I Could Only Rely On 3 Investing Metrics Part 3 – CCC

I’m curious about everything so this leads to a wide range of reading and learning outside of value investing, finance, and investing.

In these Value Investing In Your Car Episodes, we talk about some of these things and much more including:

- Mental models

- When does value investing work best

- Where it works

- You get book reviews from everything I learn from

- I talk about the most important thing I learned in 2017

- How to learn faster

- Useless investing metrics

- If I could only use 3 investing metrics, what would they be

- And much more…

If you want to learn from the other episodes in this series, you can watch the entire playlist here.

Sign up to our mailing list here and get 5 Free Gifts that will help you evaluate stocks better and faster. One of these allowed me to evaluate 3,943 stocks in 40 days manually... And I want you to have it for free.

Several weeks ago, I finished up a series on the 4 Most Useless Investing Metrics – you can view these posts below.

- Here I detailed why P/E is useless

- Here I detailed why beta is useless

- Here I detailed why 99.9% of the time goodwill is useless

- And here I detailed why 99.9% of the time synergy is useless

I then started another series answering a question I got on Quora several years ago – If I Could Only Rely On 3 Investing Metrics What Would They Be?

- In the first video in this series, I told you why FCF / Sales would be the one I rely on

- Next I told you why Return on Invested Capital or ROIC would be one of these metrics

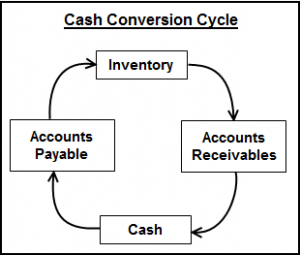

- And today, we finish up this series and I tell you why the Cash Conversions Cycle or CCC is the final metric I would rely on

Let’s get to it.

The Cash Conversion Cycle

In the 21-minute video above, I detailed the following reasons why like FCF / Sales and ROIC; if I could rely only on 3 investing metrics, CCC would be one of them.

- Why it’s so useful

- How it’s calculated

- Why I calculate it this way

- What CCC shows

- Why it’s so important

- Especially for retailers and companies that have hard assets they sell

- How it can help you evaluate management

- How it can show you several different clues to look at in financial statements

- And more…

What are your thoughts on CCC? Do you rely on it a lot? If so, how? Let me know in the comments below.

For a great free training video on CCC that I did with a past client, go here.

P.S. If you want to become a better value investor fast, make sure to check out our Value Investing Journey Masterclass. There are ONLY 7 spots left for our special offer that you will only hear about if you set up a call with me by using the prior link as well. The special offer, available to only 7 more people, is 5 FREE one on one training sessions with me.

P.P.S. Go here to get on our free mailing list where not only will you get updates first on sales, content, videos, new courses, etc., but you’ll also get 5 free gifts that will help you become a great value investor faster as well.