Value Investing in Your Car Episode 31: Why I Don’t Use DCF Valuations

I’m curious about everything so this leads to a wide range of reading and learning outside of value investing, finance, and investing.

In these Value Investing in Your Car Episodes, we talk about some of these things and much more to help you become a better value investor faster.

- Mental models

- When does value investing work best

- Where it works

- You get book reviews from everything I learn from

- I talk about the most important thing I learned in 2017

- How to learn faster

- The 4 most USELESS investing metrics

- If I could only use 3 investing metrics, what would they be

- And much more…

If you want to learn from the other episodes in this series, you can watch the entire playlist here.

Get FREE access to 17 of our best training videos from the past by clicking here.

Today I tell you why I don’t use DCF (discounted cash flow) valuations.

Why I Don’t Use DCF Valuations

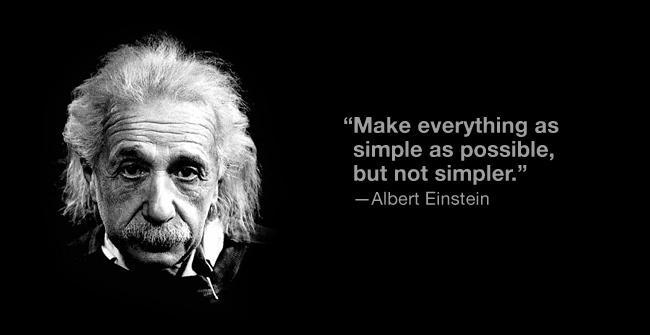

Almost everyone in the realm of finance and investment tries to make things as complex as possible for several reasons…

- They’re trying to look smarter than they are

- They’re trying to show off

- They don’t really know what they’re doing

- They’re trying to confuse people

- They’re trying to hide information from people

- Among other things…

I believe in the exact opposite.

I work to make things as simple as possible so that:

- I understand everything fully in whatever it is I’m doing

- Finance and investing is complex in many areas – so anywhere you can create simplicity, you need to do so

- I teach a lot of other people how to do what I do so I have to be able to explain things in easier to understand terms so they don’t get bogged down in the complex and nuanced explanations of situations

The simplicity of everything I do when value investing, nothing of which requires higher than 6th-grade math, is one of the main reasons I don’t use DCF valuations.

To find out the other reasons, watch this video below.

In the 15-minute video above, I tell you several reasons I don’t ever use DCF valuations.

Some of the things I talk about in the video are:

- Why the first time I came across DCF valuations turned me off on them forever

- Why I value simplicity

- Why everything I do can be done if you know 6th-grade math

- Why I can value a business 12+ ways in less than an hour using ‘back of the envelope’ valuation techniques

- And more…

Did I miss something? Do you love and use DCF valuation? Let me know in the comments below.

If you want to become a world-class value investor faster, click on the link to my post on this below.

https://www.valueinvestingjourney.com/2018/01/throwback-thursday-10-tips-to-becoming-a-world-class-investment-analyst/

P.S. Go here to get on our free mailing list where not only will you get updates first on sales, content, videos, new courses, etc., but you’ll also get five (5) free gifts that will help you become a great value investor faster as well.

P.P.S. We just signed up another Masterclass student and are starting our live student training and Q/A sessions on Thursday this week – August 30, 2018. If you want to become a better value investor fast, make sure to check out our Value Investing Journey Masterclass. The special offer, available to only 6 more people, is five (5) FREE one on one training sessions with me.